For over 30 years, Australian Hybrid Securities (AT1) have played an important role for investors and issuers alike. They have added diversification and fitted neatly between traditional equity and debt investments.

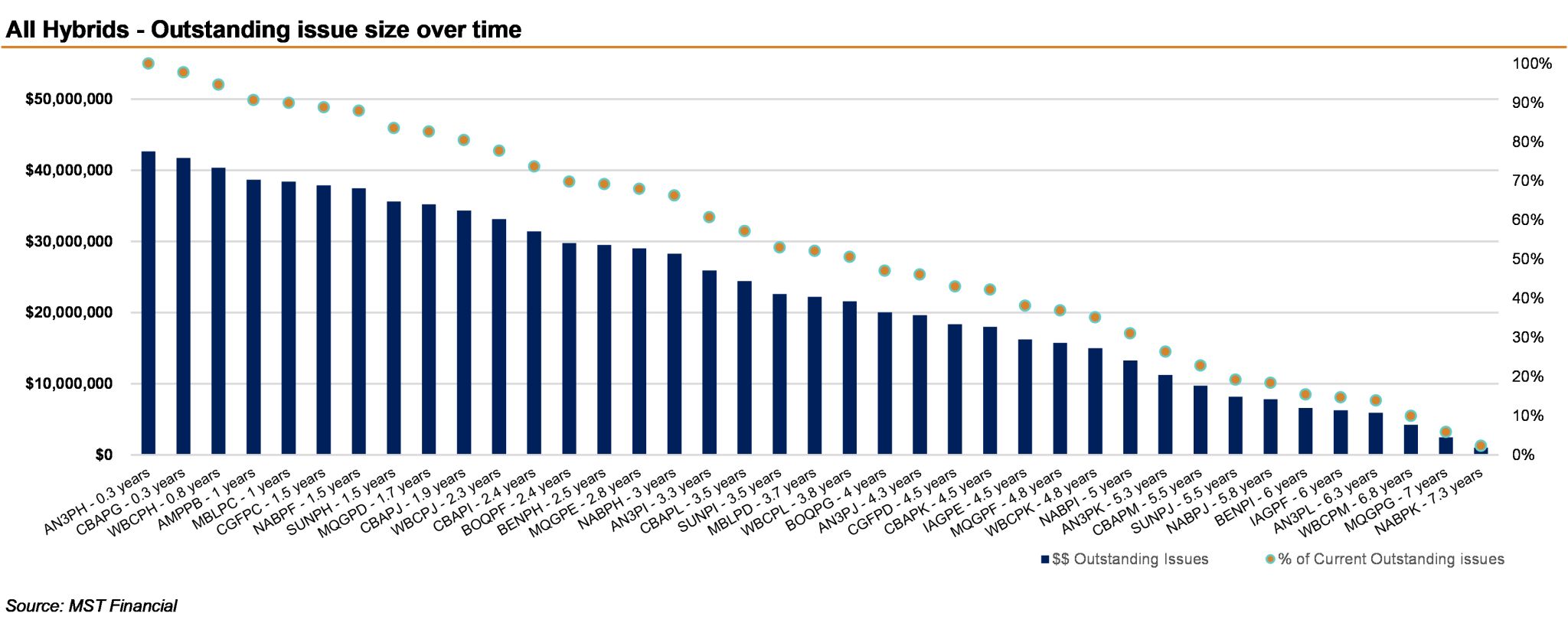

This week, APRA confirmed it will phase out the use of Additional Tier 1 (AT1) capital instruments (commencing on January 1, 2027) to simplify and improve the effectiveness of bank capital in a crisis. Whilst there is still the possibility of some further issuance, the current outstanding hybrid universe (39 issues and totalling c $42.6 billion) will reduce over the next 8 years as the securities are called. The chart below, highlights future outstanding issue size assuming no further issuance and securities called at their first call date, respectively. Interestingly, it will take 4 years to get to a market size of $20 billion (18 securities remaining) and 5.5 years to get to a $10 billion outstanding issue size. In that time, we expect to see new debt style issues as well as innovative equity-based strategies offering investors alternative income products.

At MST Financial, we have recently launched an Income Strategy designed to help investors position their portfolios to maximise the opportunities that arise throughout the transitional period. The portfolio offers investors exposure to ASX Listed Australian Financial Capital Securities, including both Hybrid Securities and Subordinated Debt ETFs.

The strategy is co-managed by Cameron Duncan and Steve Anagnos, who both have a 35 year + history in Australian Hybrid and Debt Markets. Given their collective experience, the MST Financial investment team is well positioned to take advantage of any increased flow and secondary market price volatility, and opportunities that will result from the APRA changes.

The Sandstone Income Portfolio has been awarded a 4 star “Superior” rating (“Suitable for inclusion on most APLs: High Investment Grade”) by independent research house, SQM Research.

The Sandstone Income Portfolio (Separately Managed Account) is available on the Praemium platform.

If you would like details on the Sandstone Income SMA or would like a copy of the SQM Research Report, please contact our Investor Services team on +61 2 8 999 9961, or [email protected], or through our website www.mstfinancial.com.au.